What is Binary Logistic Regression Classification and How is it Used in Analysis?

ElegantJ BI

OCTOBER 17, 2018

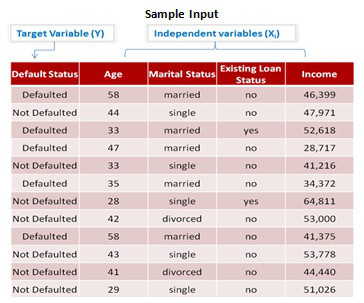

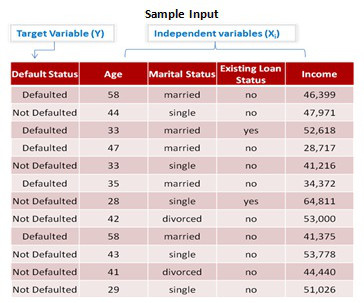

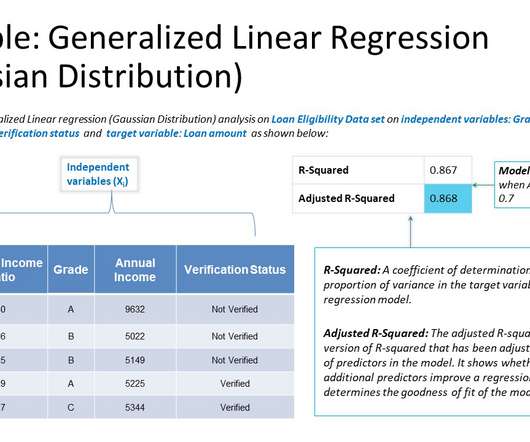

Use Case – 1 Business Problem: A bank loans officer wants to predict if loan applicants will be a bank defaulter or non defaulter based on attributes such as loan amount, monthly installments, employment tenure, how many times has the applicant been delinquent, annual income, debt to income ratio etc.

Let's personalize your content